Chinese Stocks Jump Following Xi's Bullish Comments On Tech, Emphasis On Supporting Market

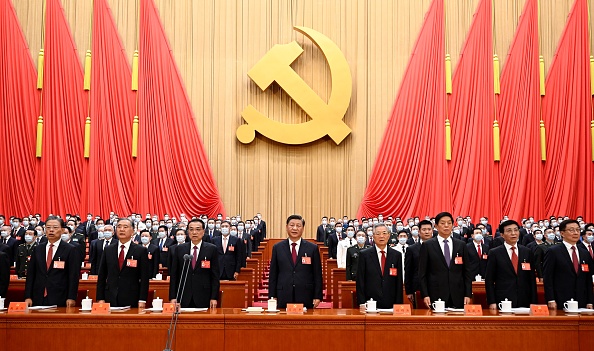

The iShares China Large-Cap ETF (NYSE: FXI) jumped Monday morning after China’s President Xi Jinping delivered a speech emphasizing supporting markets.

He suggested the long-lived crackdown on Chinese tech stocks may be nearing an end, and encouraged Chinese companies to buy back their beaten-down stocks.

What Happened? Xi delivered a speech at the opening of the 20th Party Congress on Sunday as he secured a third term in power in China.

In the speech, Xi defended his zero COVID policy, which has significantly weighed on China’s economic recovery from the pandemic.

In addition, Xi announced several measures to support China’s struggling stock market, including encouraging share buybacks and easing restrictions on short-term transactions by foreign mutual funds.

Xi also touted a push for tech self-reliance, which sent shares of Alibaba Group Holding Ltd – ADR (NYSE: BABA) up 6.4%, Tencent Holdings ADR (OTC: TCEHY) up 3.3% and Baidu Inc (NASDAQ: BIDU) up 2.5% on Monday.

Why It’s Important: Chinese stocks, particularly within the tech sector, have gotten crushed by a wave of headwinds in recent years. Chinese regulators have imposed a crackdown on big tech stocks in an attempt to rein in their power and influence.

In addition, U.S. regulators have enacted their own set of more rigorous accounting standards for U.S.-listed Chinese stocks that threatens to de-list shares of any Chinese company that does not comply.

While most of the rest of the world fully reopened their economies in early 2021, China is still enacting periodic lockdowns of major metropolitan areas, including full or partial quarantines of more than 300 million people as recently as last month.

To complicate matters further, the U.S. recently released a new set of rules restricting the sale of advanced computing semiconductors or related manufacturing equipment to China. The export controls are aimed at protecting U.S. national security and foreign policy interests.

Along with restricting U.S. sales of semiconductor technology to China, the new rules also require foreign companies to license American tools used to produce high-end chips sold to China.

As a result, the FXI ETF is down 39.8% overall in the last three years, while the SPY ETF is up 22.8% in that time.

Economic uncertainty in China is spilling over into the U.S. market as well. LPL Financial Chief Equity Strategist Jeffrey Buchbinder said Monday that it’s clear that consensus S&P 500 earnings estimates for 2023 are too high at this point, but it’s not so clear just how much they need to come down.

“Supply chain disruptions related to China’s zero-COVID-19 policy persist. Retailers still have inventory problems,” Buchbinder said.

Monday’s rally was a much-needed temporary relief for Chinese stock investors, but Chinese stocks remain extremely high-risk speculative investments at this point.

Until investors get a clear picture of what the new normal is for a post-pandemic Chinese economy and just how much growth Chinese companies can maintain under the gun of both Chinese and U.S. regulators, buying the dip in beaten-down China stocks is far from a safe bet.

Produced in association with Benzinga.

The Western Journal has not reviewed this story prior to publication. Therefore, it may not meet our normal editorial standards. It is provided to our readers as a service from The Western Journal.

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.