China Is Facing a Crash That Will Make America's 2008 Crash Look Like a Fender-Bender

As China prepares to release its latest population census, those familiar with the research are noting it will show the nation’s first-ever population decline since records were started in 1949.

The shocking development comes despite the relaxation of the country’s controversial one-child policy in 2015, according to the National Post.

Many societal and economic imbalances that threaten the world’s second-largest economy are coming to light. After reportedly surpassing a population of 1.4 billion people in 2019, the latest Chinese census is expected to report a population of less than 1.4 billion, though, according to the South China Morning Post, China’s official statistics bureau is dragging its feet and is late in reporting the numbers.

China’s problems transcend those of other advanced economies with aging populations. With fewer younger people to care for a growing elderly population, China is moving up the ranks to join Japan and Italy — countries with the largest percentage of elderly people, according to the Population Reference Bureau.

However, unlike its counterparts, China faces a slew of other problems that a drop in population only exacerbates.

Gender and Generational Imbalance

For decades, China has had millions more men than women. In 2010, Forbes reported for every 100 girls born, there were 122 boys, and once that generation reaches maturity, one in five men will be unable to find a bride. In 2018, The Washington Post reported China’s census numbers meant 34 million men — the population of California — would never marry and would rarely have children of their own.

This imbalance has fueled human trafficking, infant and child kidnapping, and the desertion of rural areas so severe Newsweek reported China’s leader, Xi Jinping, basically admitted China can no longer feed itself.

However, less understood is the striking generational imbalance that exists in China. The alarming age disparity is made abundantly clear when comparing China’s population by age with that of the United States.

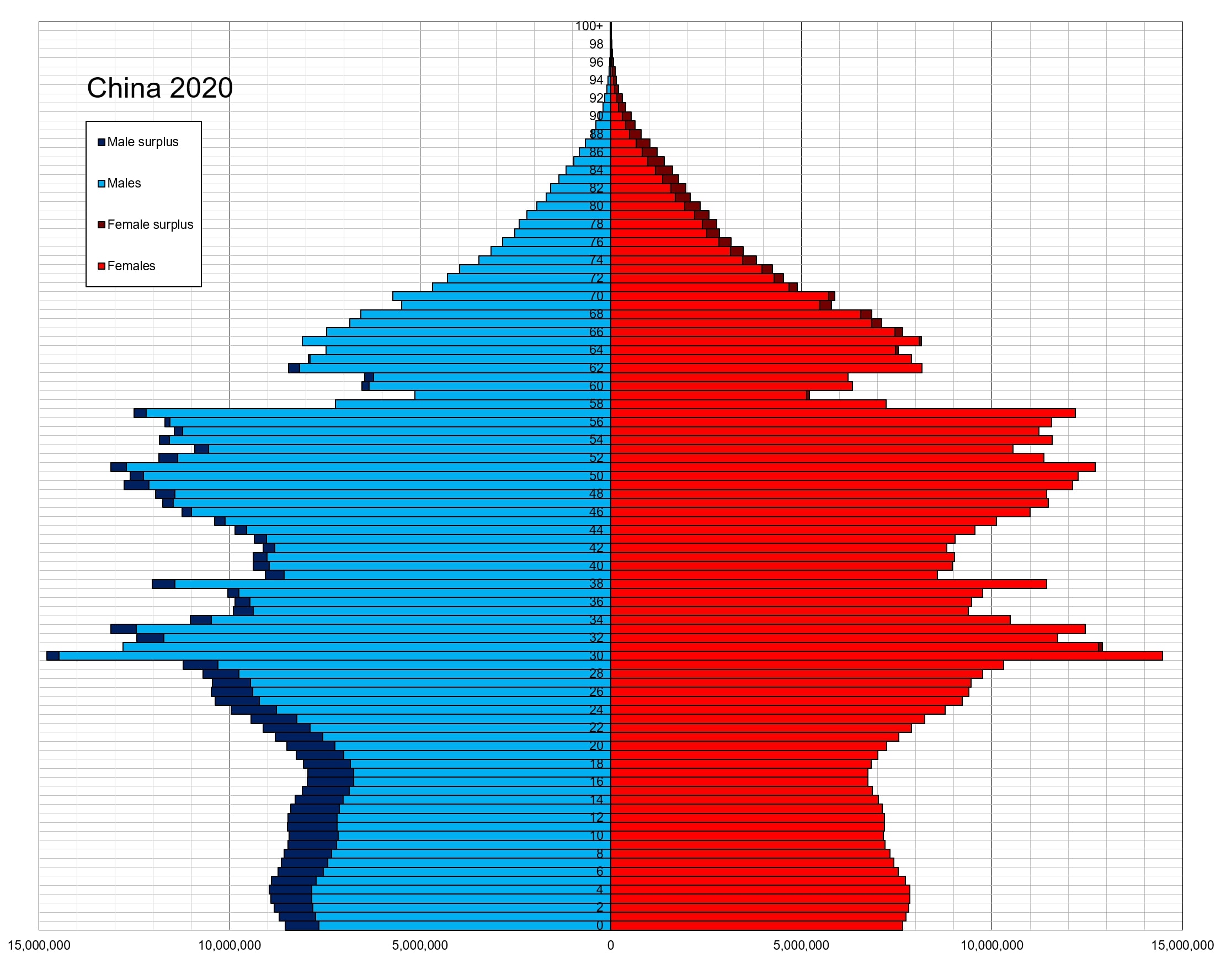

China’s Demographics Chart 2020

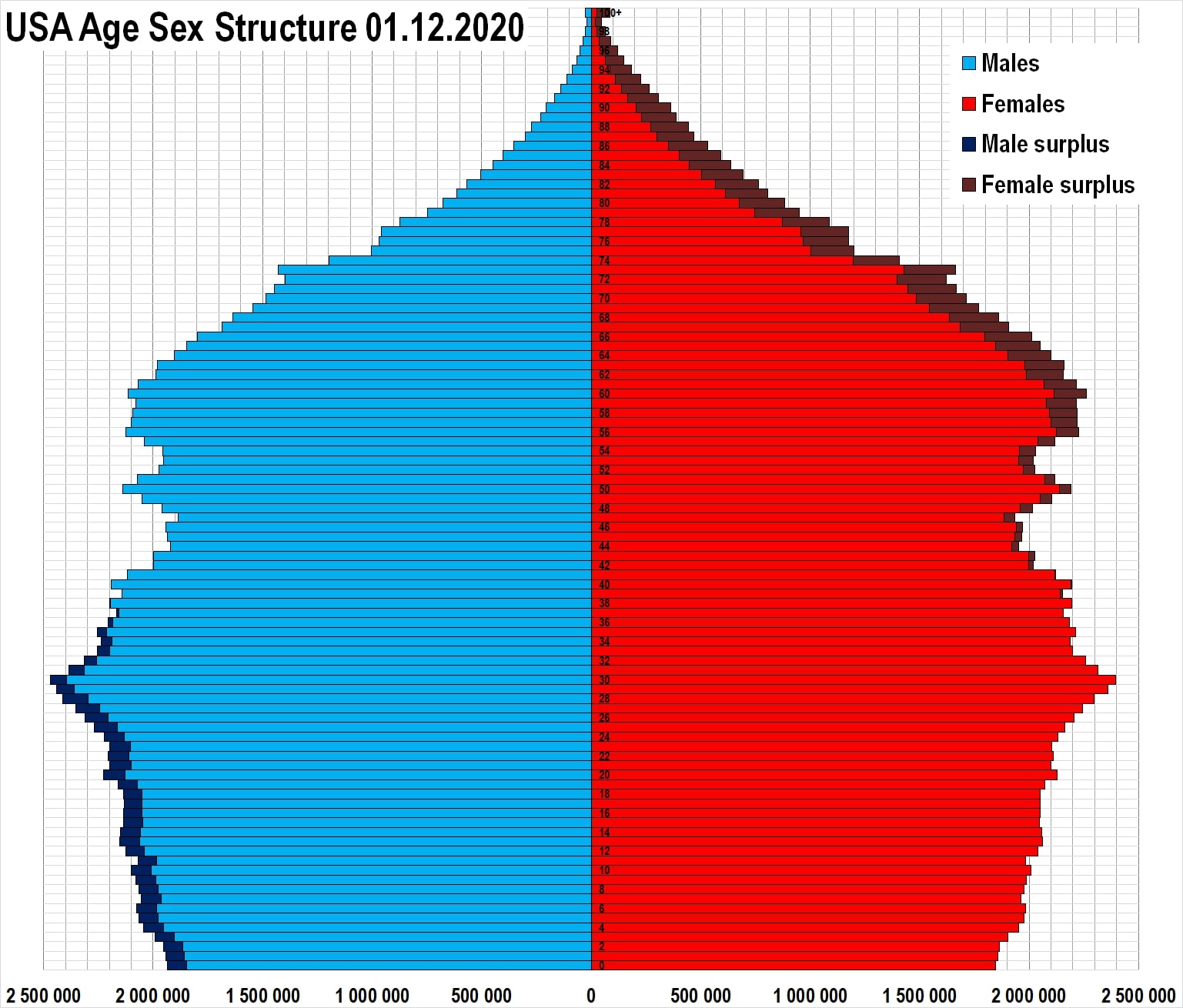

United States’ Demographics Chart 2020

Dividing these pyramids into three broad age categories, with retirees at the top third, producers in the middle, and children and students at the bottom, America’s graph looks pretty stable.

As students get ready to move into the producing category, a relatively equal number of workers are preparing for retirement. There is not a large disparity between the number of workers supporting the number of retirees who, in America, have the added benefit of investing for retirement in a capitalistic economy.

China’s pyramid, on the other hand, appears downright frightening. As the producers move into retirement, the new workers will be far fewer in number. Decades of communism enforcing artificial constraints and requirements on society have resulted in a graph that, even at a quick glance, looks unhealthy.

Dependency Ratios Highlight the Problem

With producers supporting the other two groups, an important statistic to examine is the dependency ratio: the number of people under the age of 15 and over the age of 64 compared to the rest of the population. While inexact, the ratio gives a rough idea of how many children and retirees likely rely on the producers in any given country.

The larger the percentage, the greater the burden those in the labor market carry for those who are not. They are the ones paying for education, health care and social security through taxes. They are also the sole driver of a country’s GDP.

According to the CIA Factbook, the current total dependency ratio for the U.S. is 53.9 percent, while China’s is 42.2 percent. Roughly half of the population supports the other half in both countries.

However, after decades under China’s one-child policy and stringent immigration restrictions, the ratio is expected to rise in the country. In fact, studies from China’s own Peking and Renmin Universities have projected that by 2050, the dependency ratio is expected to top a whopping 70 percent. One worker will have to support almost three non-workers.

And a study published in The Lancet forecasts after hitting a maximum population of 1.4 billion, China will lose nearly half its population by the end of the century, dropping from the first to the third most populous country, with 732 million people. Meanwhile, the U.S. was projected to continue its gradual growth trend and hit 336 million by 2100.

An Aging China

China has a strong tradition of adult children taking care of their aged parents. A study in the Journal of the American Medical Directors Association reported only 1.5 percent of older Chinese people live in some sort of assisted living. In the U.S., 6.5 percent of people over the age of 65 do, according to Nancy Wellman of the Friedman School of Nutrition Science and Policy at Tufts University.

However, since the 1970s, parents have had only one child, so a married couple might now take care of four parents and possibly even more grandparents. At the same time, they work longer hours while they raise their own child in a hyper-competitive environment, where parents have to compete for limited spots at the best schools. China’s culture makes having a second child extremely difficult, which further perpetuates the aging problem.

What Does Chinese Retirement Look Like?

Even though China has more than four times the population of the U.S., its national security fund held $922.8 billion in 2020, according to SCMP, compared to $2.9 trillion in America’s Social Security Trust.

Of course, the average Chinese worker makes less than their U.S. counterpart, but the margin is not as wide as the above numbers appear to indicate. In 2019, the average Chinese worker working in a non-government, urban company made 90,501 yuan ($13,980), according to data published on Statista, while the average American worker made $31,133, according to data from the U.S. Census Bureau.

As far as China-funded pension payouts go, there is a wide discrepancy if the retiree worked for the government, private industry or was — heaven help him — a farmer. But, for the average non-government urban worker, the pension paid out 37,840 yuan ($5,845) annually in 2018, according to the China Labor Bulletin.

By contrast, Social Security paid the average American $16,848 in 2018, according to The Motley Fool. But the alarming comparison comes from the total payouts for the year. Recall China’s total fund is less than a third the size of America’s, yet while the U.S. paid out $13.8 billion in 2018, according to the SSI Annual Statistical Report, China paid a whopping 291 billion yuan ($45 billion), according to the CLB.

It’s no wonder “the People’s Bank of China warned China had only about a decade left to enjoy the benefits of its large working-age population, which has helped propel growth over the past four decades,” according to the SCMP. And last year, the Chinese Academy of Social Sciences forecasted the pension fund will be exhausted by 2035.

Voice of America recently summed up the resentment of an overworked population looking at an underfunded retirement by quoting an anonymous source: “The point of [encouraging] us to work the 996 schedule [9 a.m. to 9 p.m., six days a week] is that we can work to death before we retire so as to perfectly save the country’s under-funded pension system.”

The Penny Drops — Saving for Retirement in China

In the U.S., retirees likely have investments such as 401(k) plans or IRAs to supplement Social Security, and the average family has $255,130 saved by retirement age, according to The 2019 Survey of Consumer Finances. However, China has a unique problem: its citizens do not trust its stock market.

A 2015 study revealed nearly one-third of Chinese respondents do not trust financial institutions with money. Barron’s reported on the China Retirement Readiness Survey 2020, which found only five percent of those questioned invested in the domestic stock market.

Young Research & Publishing puts it this way: “China is a command style economy run by an unelected political party — the Chinese Communist Party (CCP). The CCP’s policies have resulted in a grand misallocation of capital. A mercantilist currency policy, perverse incentives for provincial government officials, and crude monetary policy tools have helped inflate a fixed asset and real estate bubble that puts the U.S. real estate bubble to shame.”

So, if the Chinese stock market is not an attractive avenue to invest money and the CCP essentially prevents its citizens from investing overseas, where can Chinese workers turn to invest for retirement?

Chinese Real Estate and Ghost Cities

The $52 trillion answer is that real estate remains the top source for Chinese investors.

“The total value of Chinese homes and developers’ inventory hit $52 trillion in 2019 … twice the size of the U.S. residential market and outstripping even the entire U.S. bond market,” The Wall Street Journal reported. “Urban Chinese have bet everything on their homes. They now have nearly 78% of their wealth tied up in residential property, versus 35% in the U.S.”

That certainly is born out in the housing market, where property in China is by no means cheap. When comparing apartment costs in the center of the five most expensive cities in China and America, the average price in China was $13,211 per square meter, according to Numbeo, compared to $15,173 in America, even though Chinese workers earn less than half their American counterparts.

Why is housing so expensive? A clue can be found in the “ghost cities” — the nearly empty cities that have sprung up throughout China. Fueled by local governments looking to raise funds by seizing rural land to sell to developers, as SCMP reported, entire cities with high-rise apartments seemingly sit abandoned. Shockingly, over 20 percent of all urban housing — 65 million homes — have actually been purchased, yet remain empty, according to Bloomberg.

The outlet reported 44 percent of all homes purchased in 2018 were bought as a second home, and a quarter were third-home investments. Only a little more than 30 percent of all home sales were for people to actually live in.

In a country where investors shun the stock market, property values are red hot. China Daily/Asia News Network reported “in the first quarter of [2021], nationwide residential property investments soared nearly 29 percent year-on-year to 2.06 trillion yuan ($320 billion).”

With the looming population crash, what will happen to the housing market and property values? More importantly, what will happen to the millions who are financing their retirement with investment homes?

There and Back and Again

China stands at a unique precipice in world history. Poised to lose half its population by the end of the century, its aging populace is pouring their life savings into investment homes in the hopes of selling to a future generation drastically smaller than the current one. An entire generation is looking to fund a retirement that seems impossible.

The looming housing crash in China may make America’s crash in 2008 look like a mere fender-bender.

And the bad news doesn’t stop there. With the rising middle class in China, it simply makes less business sense for foreign firms to continue manufacturing in China.

Prince Manufacturing reported “U.S. companies are leaving China. Technology companies such as Hewlett-Packard, Dell, Microsoft, and Amazon are actively seeking to move significant parts of their business capacity outside of China. In the case of HP and Dell, these companies are seeking to reallocate up to 30% of their China-based activity to other countries.”

“Additionally, toymaker Hasbro, Bath & Body Works parent company L Brands, and fashion designer Steve Madden have all outlined plans to substantially reduce their dependence on Chinese factories in the next few years.”

Similar to what occurred in Japan a generation ago, China is pricing itself out of the market. However, unlike Japan, China faces the result of myriad artificial forces and misguided ideologies forced upon its society and economy by decades of communism.

No one sees this bleak future better than China itself. The country has realized its current growth and success are not sustainable, which is why it is spending $50 to $100 billion per year on its Belt and Road Initiative.

While China is still an economic force to be reckoned with — and despite multiple allegations of forced labor — it is growing its sphere of influence to make other countries more dependent upon it.

The country’s bleak future also fuels China’s effort to construct islands and fortifications in the South China Sea. China wants to exert itself as a military super-power since its might as an economic powerhouse will fade. In this regard, it’s following the playbook of the other major failed communist experiment: the Soviet Union.

Only time will tell how much China will suffer and how much suffering it may inflict on the rest of the world.

China is not a healthy country, and its imbalanced population speaks loudly of this. As one Chinese dissident wrote: “When you don’t want children, you force people to get sterilized. When you want more, you urge us to give birth. What do you think I am?”

Friedrich Nietzsche nods in approval.

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.